Governance

Before we talk about governance...

When we were designing the Slips model, we put all the different actors on a board and tried to work out how we could align everyone's interests. Players for example, do not particularly care for cryptocurrencies either way. They just want to get paid consistently.

For teams, we have a franchise model with 24 teams available. So team owners have no issues buying a seat at the table to compete for $SLCC prize pools every season.

For the most part, the model worked and incentives were aligned. Except we could not provide a compelling story for ordinary speculators and market makers to provide liquidity to Slips.

Why the order book model does not work for cryptocurrencies

The Nasdaq, FTSE 100, and NYSE all work on the order book model. So do all the traditional cryptocurrency exchanges like Bitfinex, Binance and Coinbase. In the order book model, the centralized exchange creates a place for buyers and sellers to come together and place orders.

They have a system that matches orders. The buyers will try to buy for the lowest price possible. Sellers will try to get the highest price and eventually they will both converge on a price.

The problem is that sometimes the buyers and sellers might not be willing to converge on a sensible price. Sometimes they might not even be enough supply of the coin for you to buy in the first place! That's why market makers are needed. These folks provide liquidity to the order book by being willing to buy or sell whatever asset you want to trade.

What do these market makers get for providing this service? They turn a profit on the bid-ask spread. For example the market maker might be willing to buy your $COMP for $110.00 which is the bid price. They would then sell it for $110.05. The $0.05 difference is called the spread. This might seem like a small amount but the daily trading volume of $COMP was $26,580,757 recently so if one single market maker covered all the trades, they would make $1,329,037 that day!

Why we need liquidity pools instead of market makers

Without these market makers, the order books on exchanges would be completely illiquid. This would suck for users. But for market makers to operate, they need to be sending a huge number of orders and cancellations to the exchange. You can immediately see the problem!

Ethereum produces blocks every ~10 seconds and for the last seven days, the average fees have been in the ballpark of $1.50. These kinds of delays and fees would drive most market makers to ruin just for managing their orders!

So liquidity pools then, how do they work?

Liquidity pools are an upgrade on clunky decentralized order book style exchanges like Etherdelta.

A liquidity pool is a smart contract that allows a "liquidity provider" to deposit tokens into it which forms a market between those tokens. A basic pool would allow for two tokens to be deposited forming a pair like "ETH-DAI". Projects such as Balancer have been launched that can allow for up to 8 different tokens to be deposited into a pool.

When a liquidity provider adds tokens to a pool, they receive special tokens in return in proportion to how much liquidity they provided. These are called "LP" tokens. To get the liquidity (and any fees they gained) back, the provider has to burn their LP tokens. Each time trade is made through a pool, a fee is charged on the transaction and distributed to all the providers who hold LP tokens.

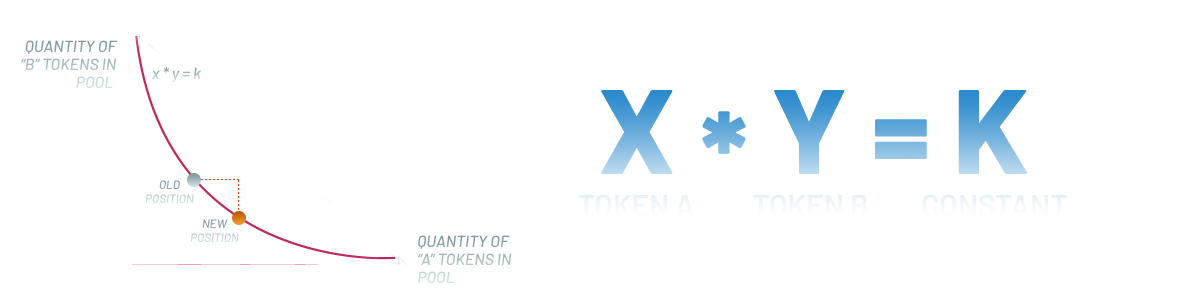

The price of the tokens in the pool depends on the ratio of the tokens in the pool. If we created an ETH-DAI pool and took into account current market values of the two tokens (1 ETH = $379 and 1 DAI = $1). To provide the pool with both tokens in equal rations we would need to put in 10 ETH ($3790) and 3790 DAI ($3790).

What would happen if we did not put equal ratios when we first supplied liquidity to this pool? Well we would create an instant arbitrage opportunity for someone else and lose some money. The liquidity pools uses a formula (X * Y = C) to maintain the same quantities of the tokens in the pool.

This means if you buy ETH from our ETH-DAI pool, in effect reducing the supply of ETH, the algorithm of the pool will increase the price of ETH and the DAI price will be reduced. Since the price of ETH in the pool might have diverged from the price of ETH on an exchange like Coinbase, an opportunity arises for an arbitrageur to buy ETH from CoinBase and sell it to the pool.

With a liquidity pool, there is always liquidity for a trade (no matter how large it is) although with the price reaching increasingly high levels. Bigger trades require bigger pools to lessen the impact of price changes. This is known as slippage but let's end the theory for now and go back to discussing governance.

So how does governance work in Slips?

We took the long way to get here because we needed to explain liquidity pools to explain how the governance token is distributed. Slips will use a liquidity pool to provide players an easy way to cash out and for team owners and investors an easy way to purchase $SLCC.

In order to incentivize traders to provide liquidity to the $SLCC liquidity pool, we allow them to stake their liquidity pool tokens in order to yield farm the Slips League Operation Coupon ($SLOC) governance token.

The governance token can then be staked through our soon-to-be-release governance application allowing stakers to have a vote in all the league operations decision making. Unlike other DeFi protocols, we also allow you to make proposals as well. This means that farming the $SLOC token will allow you to decide how much the prize pool will be, how teams will be drawn, how the league will look and what fees we will charge for transactions.

But that's not all, the liquidity mining of $SLOC has other benefits as well...

What benefits do you get from accumulating the governance token?

Apart from being able to create proposals and vote on decisions related to the operation of the league, the Slips League Operation Coupon ($SLOC) also gives holders preferential access to the draft. You can read more about how the player draft works.

But in a nutshell when a player joins the league, they are tokenized and the token instance is held by the league until an investor or team owner buys it out by paying the base value of the player to the league.

Initially the value of the player is derived from their rank. Later on, the value is affected by how well they play. So getting an early draft pick allows you the opportunity to snap up valuable player contracts at a discount. Especially when compared to buying an existing player's contract from another team.

How are we going to prevent the governance token being centralized in the hands of the few?

A large number of liquidity mining schemes were launched this summer but despite the interest in these farms, many of the liquidity providers choose not to participate in the governance process.

This is understandable, people want the easiest route to riches and voting can be a pain in the backside. However the result of the apathy is that decision making is left in the hands of a few powerful whales.

Like other protocols, we are asking users to lock their $SLOC tokens into our system in order to create and vote on proposals or receive draft picks. While their tokens are locked up, the price of $SLOC (which is tradeable) could be appreciating!

For most DeFi projects, the trends has been upwards. Can people really give up instant profits in exchange for a say in the future of the Slips project?

Others have tried unique ways to stimulate participation but what we've learned from their efforts is that the effects are not long lasting and making the process more complex with "Boosts" and similar creative ideas, will only serve to drive users away.

We explain one additional benefit below that we offer $SLOC holders which could offset the urge to make quick profits from our user base.

How do you trade the governance token?

There will be Uniswap markets for the Slips League Operation Coupon ($SLOC) token but token holders will have to make a decision on whether they want to trade their tokens, losing influence over the project in exchange for a short term financial gain.

For a lot of DeFi projects, as explained in the section above, power finds itself consolidated into the hands of a select few whales or becomes moot when a majority of holders cannot be bothered to participate in the governance process.

Since the Slips League Operation Coupon allows you preferential access to the draft (your pick order being proportional to the amount of tokens you stake) - anyone trading their tokens is giving away much more than voting rights.